student loan debt relief tax credit 2020

Instructions are at the end of this application. If youre concerned about the tax implications of your student debt or looking for ways to get a break on your outstanding education loan you should read this article.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for.

. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. The good news is that in some cases student loan. Department of Education between March 13 2020 and May 1 2022.

For Maryland Residents or Part-year Residents Tax Year 2020 Only. 3 Top Rated Tax Relief Companies. From July 1 2020 through September 15 2020.

These may include loans. Tax Implications of Student Loan Debt Relief. Total and Permanent Disability Discharge.

Your Loan Could Go Into Default. Professional Help With IRS Debt. In 2019 IRS tax law allows you to claim a student loan interest deduction of 2500 on your 2018 Taxes as long as you and your student loans meet certain eligibility criteria.

Student Loan Debt Relief Tax Credit Application. The total amount of outstanding student loan debt is estimated at approximately 175 trillion including 159 trillion in federal student loans. The Student Loan Debt Relief Tax Credit Program for Tax Year 2020 is Closed STUDENT LOAN DEBT RELIEF TAX CREDIT.

Its also estimated that 432 million student borrowers owe an average of roughly 39000 each. Additionally the government can garnish your wages and seize your tax refund to try and collect. The Maryland Higher Education Commissionmay request additional documentation supporting your claim for this or subsequent tax years.

Borrowers with federal student loans have received some welcome relief when it comes to payments and interest charges since March of 2020. Deja un comentario advance payday loans Por hackeomimente1. A debt consolidation loan is one big loan North Carolinians use to pay off debt on multiple credit cards.

Under the new law no payments are required on federal student loans owned by the US. I went ahead and logged in to the portal and. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie.

Complete the Student Loan Debt Relief Tax Credit application. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were awarded anything. In addition the interest on these federal student loans will automatically drop to zero percent between.

You must provide an email address where MHEC. If you dont make any payments on your student loans for nine months your loan will be considered in default. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings income tax credit for Maryland resident taxpayers that are making eligible undergraduate andor education that is graduate re payments on loans acquired to make an undergraduate andor.

From July 1 2021 through September 15 2021. How to Win an IRS Debt Settlement. A new analysis by the nonpartisan California Policy Lab and the Student Loan Law Initiative revealed that the student loan pause.

Mar 24 2022 1045am EDT. Provide partial debt cancellation for each borrower with household gross income between 100001 and. Student Loan Debt Relief Act legislation to cancel student loan debt for 42 million Americans.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and Currently owe at least a 5000 outstanding student loan debt balance. The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. Thats when the federal government announced a pause on.

The pandemic-related pause on student loan payments which began in March 2020 and has spanned two administrations relieved at least 26 million borrowers of their federal student debt obligations interest free for the past two years. 3 Expert Tips for Back Taxes Help. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and Currently owe at least a 5000 outstanding student loan debt balance.

Maryland taxpayers who maintain Maryland residency for the 2020 tax year. Biden Student Loan Forgiveness for 72000 Borrowers. Mar 24 2022 0830am EDT.

The student loan debt relief tax credit is offered in Maryland to student loan borrowers with outstanding debt. At that point the entire balance of your loan will be due and your credit score will take a big hit. Complete the Student Loan Debt Relief Tax Credit application.

Find out how student loan debt relief works and how you can apply. Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases January 16 2020 by Ed Zollars CPA The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had that debt cancelled in. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university.

The interest rate should be considerably lower but that depends on your credit score and whether you are willing to put up collateral like your home or. 3 Ways You Can Solve IRS Tax Problems. Its Your Last Chance To Get A Refund For Federal Student Loan Payments.

Student Loan Credit Card Debt Relief Tax Debt for Income Tax 12 Months 2020 Information. IRS Debt Forgiveness Guide. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

Everyone is always looking for ways to reduce their tax liabilities but many people have no idea that this significant tax deduction is widely available. I didnt receive anything in the mail in December about it like I did last year although everything through USPS is delayed right now. Will Congress Turn Democratic Tax Hikes Turn Into Bipartisan Tax Cuts.

Cancel up to 50000 in student loan debt for borrowers with 100000 or less in household gross income. 2020-11the IRS expanded the relief for taxpayers who took out federal and private student loans in order to attend institutions that closed or misled borrowers. So instead of 3-4 credit card payments every month you make one monthly loan payment to the bankcredit union.

What Is The Current Student Debt Situation People S Policy Project

Student Loan Forgiveness Statistics 2022 Pslf Data

What Is The Current Student Debt Situation People S Policy Project

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

What Is The Current Student Debt Situation People S Policy Project

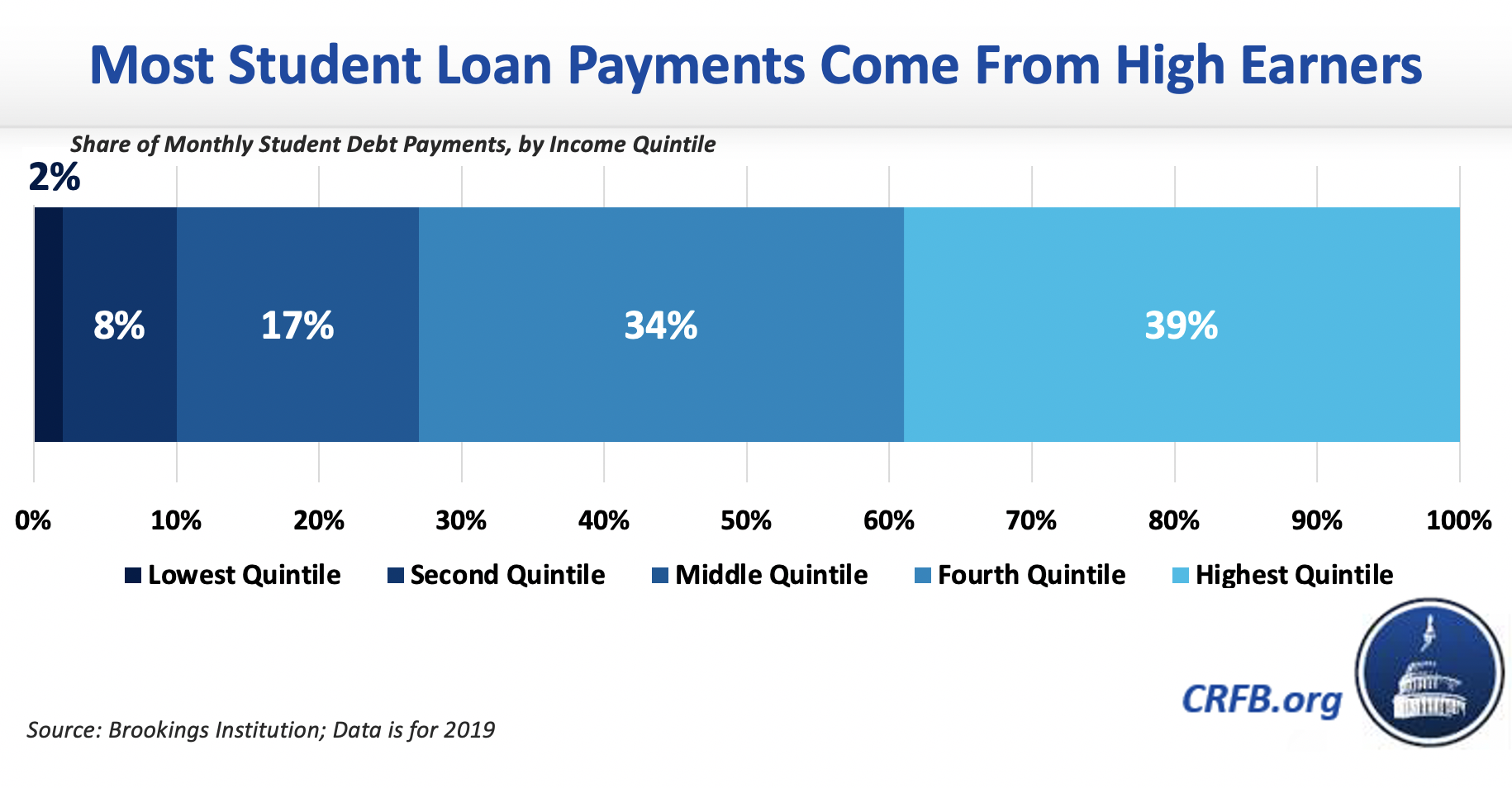

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Covid Tax Break Could Open Door To Student Loan Forgiveness Elizabeth Warren Congress Email Covid Irs The Independent

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

Promote Economic And Racial Justice Eliminate Student Loan Debt And Establish A Right To Higher Education Across The United States Equitable Growth

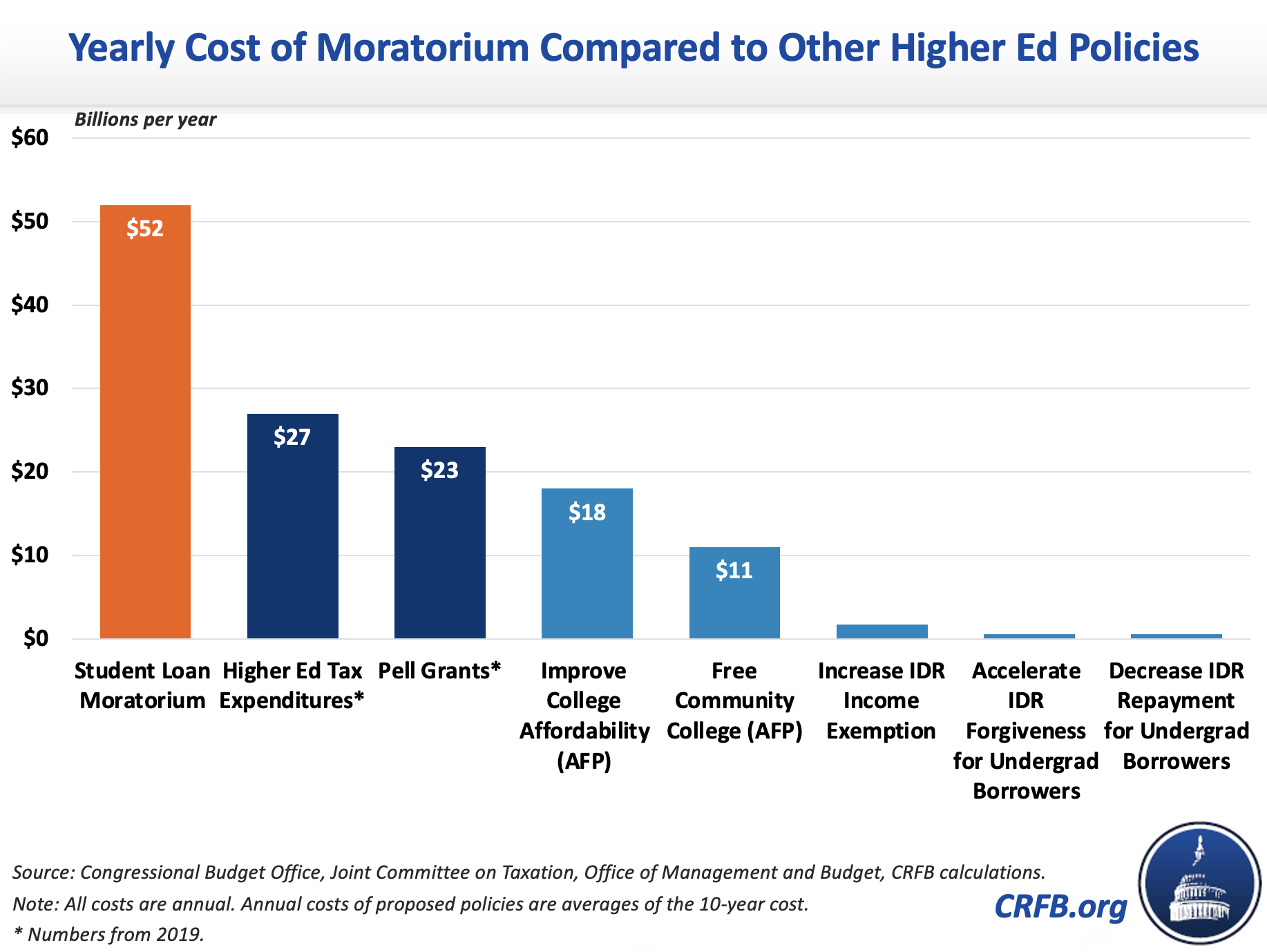

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Plan 4 Student Loans Low Incomes Tax Reform Group

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

How The Next President Should Fix America S Student Loan Problem The Economist

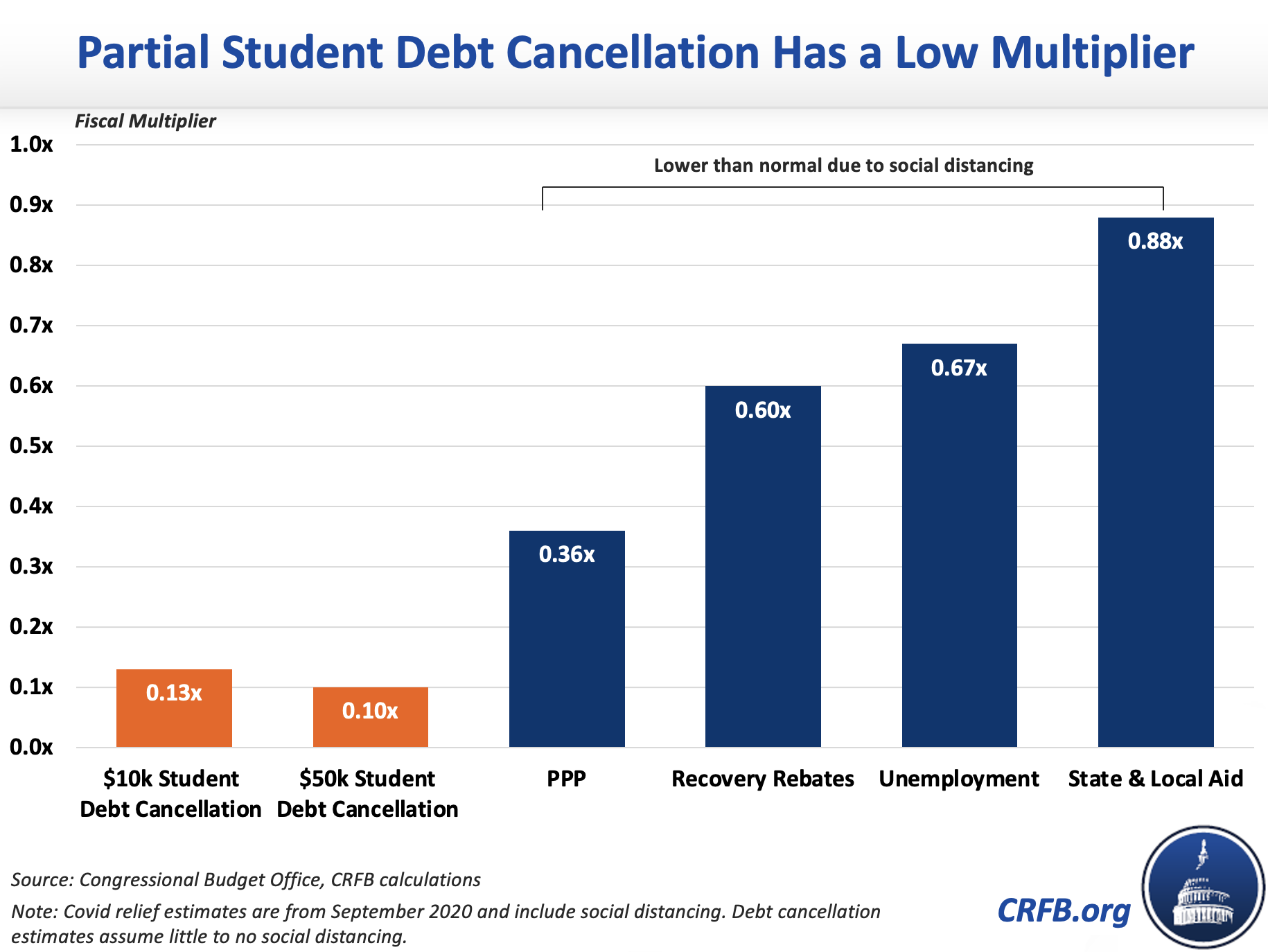

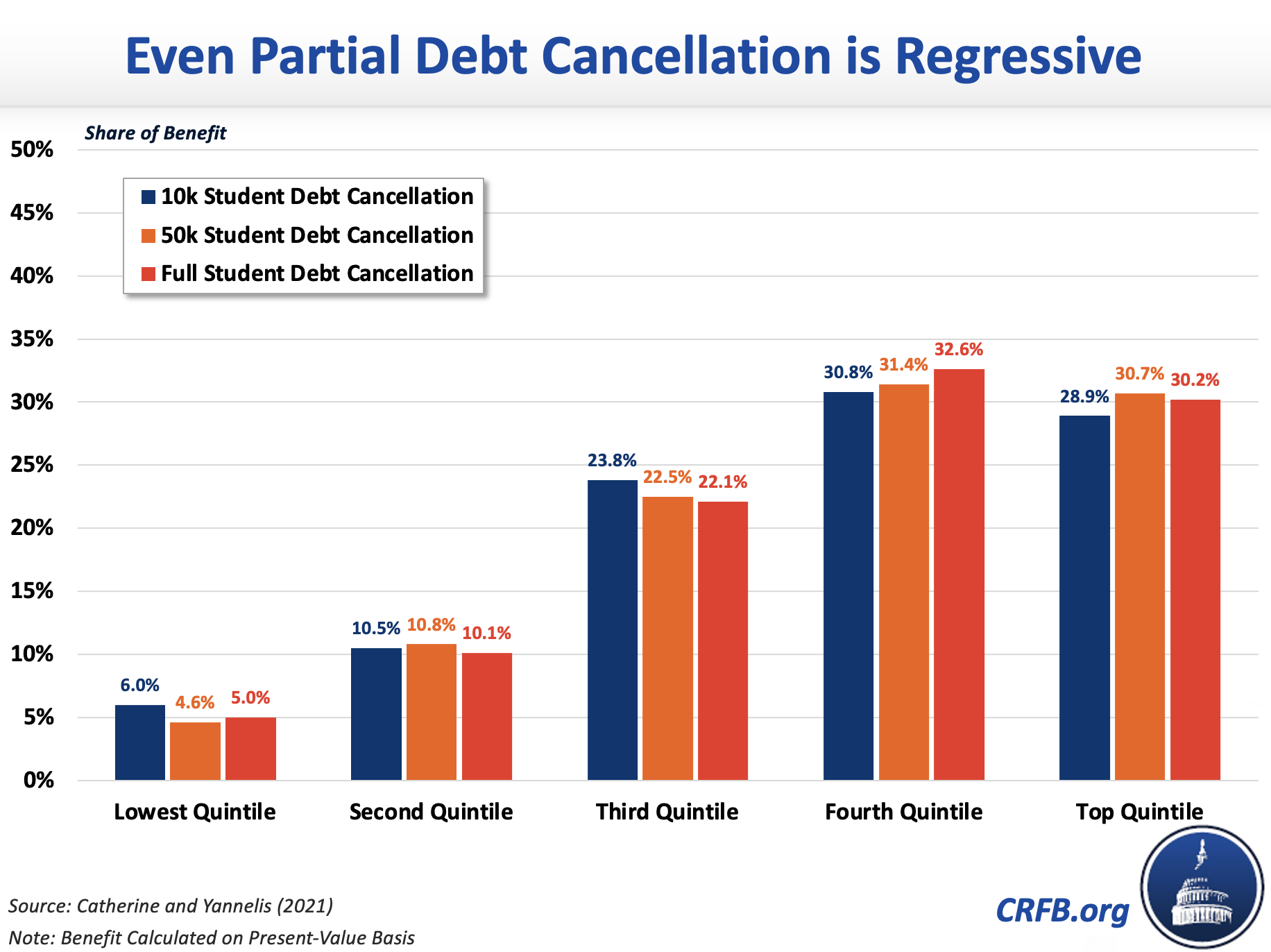

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

How The Biden Administration Can Free Americans From Student Debt The New Yorker